Understanding Financial Ratios for Small Businesses: A Comprehensive Guide

Jan 04, 2024 | 25 Min Read

Contents

Want to learn the next steps?

Our experts are here to assist you in discovering your business growth

Share This Blog

Financial statements provide essential information about the company’s financial health and performance. However, the use of financial ratios enables us to analyze different aspects of the business, which are not evident by simply looking at the business’s financial statements.

What is Ratio Analysis?

We must first ask ourselves, what are financial ratios? A financial ratio is simply a relationship between various figures appearing in financial statements. Financial ratios are not presented strictly as a ratio, but also commonly measured as percentages, number of times and number of days.

Ratio analysis is the calculation and evaluation of financial ratios to raise questions or draw conclusions about the business’s financial performance and position.

Ratio analysis is widely used by several stakeholders of the business, such as the management, current or potential investors, lenders, business analysts, and auditors. It is a powerful tool for financial analysis, enabling stakeholders to make informed decisions regarding their course of action.

What Does Ratio Analysis Tell You?

Ratios provide valuable insights into several aspects of a business’s financial performance and health. They offer comparisons with past performance, and competitors’ performance via industry averages, and also enable businesses to forecast expected performance.

Ratio analysis provides a comprehensive view of the financial position and performance of the business by analyzing the following:

Liquidity: Ratio analysis can reveal a company’s ability to meet short-term financial obligations, by determining whether the business has adequate current assets to cover short-term liabilities.

Financial Risk: Ratio analysis helps gauge the company’s long-term solvency position and hence the financial risk of the business. Is the company overly leveraged? Can it bear more debt? These are the types of questions financial ratios answer.

Profitability: By analyzing profitability, a business can determine how effective its strategies are in generating profits.

Efficiency: Ratios evaluate how efficiently a business uses its assets, especially in generating sales.

Ratios can provide a different perspective on the company’s financial performance, helping businesses to manage and plan effectively.

How are Ratios Calculated?

Each ratio answers a specific question about the business, using specific formulas and financial data points from the company’s financial statements. There are several types of financial ratios that a business can calculate.

Some common ratios and their formulas are given below:

Profitability Ratios:

- Net Profit Margin: (Net Income / Revenue) x 100

- Gross Profit Margin: (Gross Profit / Revenue) x 100

- Return on Assets (ROA): (Net Income / Total Assets) x 100

- Return on Equity (ROE): (Net Income / Shareholders’ Equity) x 100

Liquidity Ratios:

- Current Ratio: Current Assets / Current Liabilities

- Quick Ratio (Acid-Test Ratio): (Current Assets Excluding Inventory) / Current Liabilities

Efficiency Ratios:

- Asset Turnover = Net Sales / Average Total Assets

- Inventory Turnover = Cost of Goods Sold / Average Inventory

- Receivables Turnover = Net Credit Sales / Average Receivables

Leverage and Financial Risk:

- Debt to Equity Ratio = Total Liabilities / Shareholders Equity

- Interest Cover = Operating Income / Interest Expense

The above ratios are just a few of the financial ratios that are widely used by small businesses. It should be noted that care should be taken when calculating ratios, by ensuring consistency in measurements and by making use of the most recent financial statements.

Want to learn about the next

steps for growing your business ?

Application of Ratio Analysis

Ratio analysis is a versatile tool with broad applications across the financial landscape.

Small businesses can apply ratio analysis in a multitude of ways:

Assessment of Financial Health: Financial ratios assist in determining the overall financial health of the business by analyzing the ability to fulfill short-term and long-term financial obligations.

Performance Evaluation: Small businesses can utilize financial ratios to identify areas that the business is excelling at and areas for improvement.

Stakeholders Decisions: Stakeholders, whether creditors or investors, use financial ratios to assess the creditworthiness and growth potential of the business, enabling informed decisions be made before extending credit lines or investments. Managers also acquire crucial information from financial ratios, resulting in informed decision-making for the well-being of the business.

Competitive Analysis: Small business owners can compare their performance to industry standards, leading to a better understanding of the success of business strategies.

Budgeting: Ratio analysis guides small business owners in setting financial goals based on past and forecasted financial performance. Budgeting coupled with ratio analysis can assist in various internal decisions, including resource allocation, cost control, and pricing strategies.

Examples of Ratio Analysis in Use

Let’s consider some practical examples and scenarios demonstrating how ratio analysis can be used.

Profitability Analysis: Keeping the industry average as a benchmark, Company A has decided to calculate and compare its financial performance with competitors.

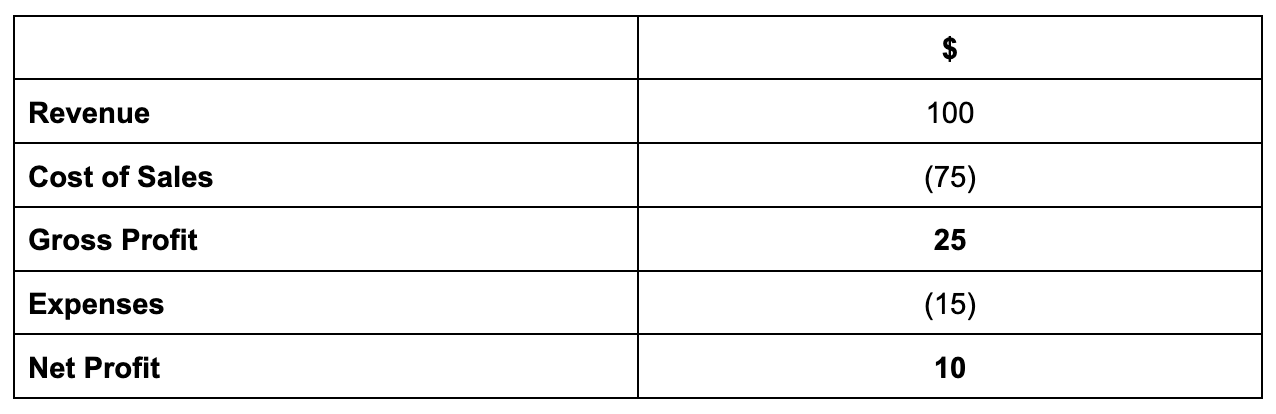

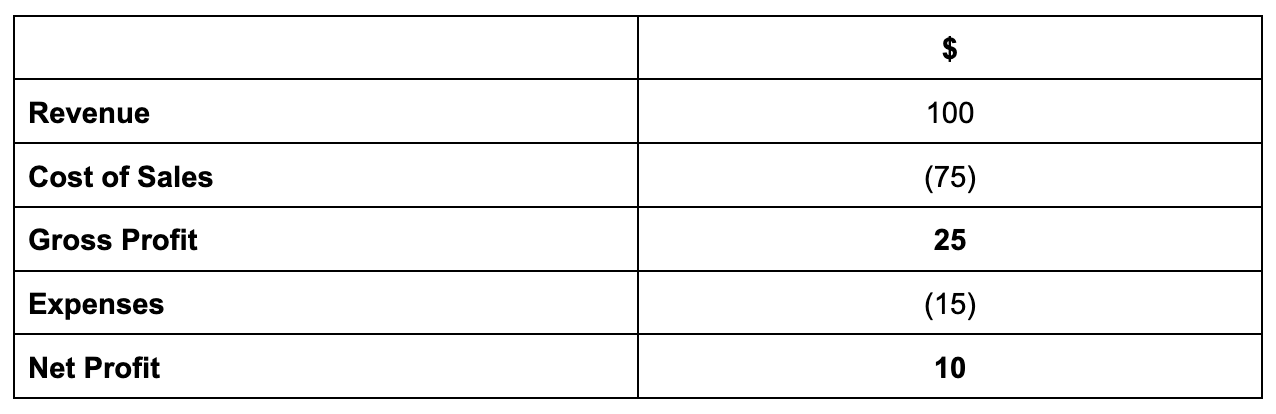

The Income Statement Extract is given below:

Company A decides to calculate the Gross Profit and Net Profit as follows:

Gross Profit Margin:( Gross Profit ÷ Sales ) x 100

Gross Profit Margin = 25 ÷100 x 100 = 25%

Net Profit Margin: Net Profit ÷ Sales x 100

Net Profit Margin = 10 ÷ 100 x 100 = 10%

The industry average is 30% and 15%, respectively. This means that competitors performed better than Company A in terms of converting sales into profits. This could be due to better cost controls or better sales margins. Company A should investigate this matter to improve profitability.

Solvency Assessment: Suppose you have a company and want to calculate your leverage position. In this case, you could consider using the Debt-to-Equity Ratio. A high ratio indicates that your business relies heavily on borrowed funds, posing a risk to future financial stability. Heavily relying on borrowed funds dents profitability as well due to higher interest payments. This insight could prompt you to reevaluate your business strategy and seek alternative financing.

Liquidity: Company A also needs to determine its short-term financial health. They may consider using either the Current Ratio or Quick Ratio (appropriate if inventory is illiquid and requires time to sell).

Company A has current assets of $1,000 and current liabilities of $500. The industry average is 1.2 times.

The Current Ratio for Company A is: 1,000 ÷ 500 = 2 times

This suggests that Company A can cover its short-term obligations with ease as its current assets are two times more than its current liabilities. It is also better than the industry average.

Simple data can be transformed into meaningful financial information that can drastically alter the course of the business. To get the best out of your financial data, consider outsourcing your bookkeeping to a professional.

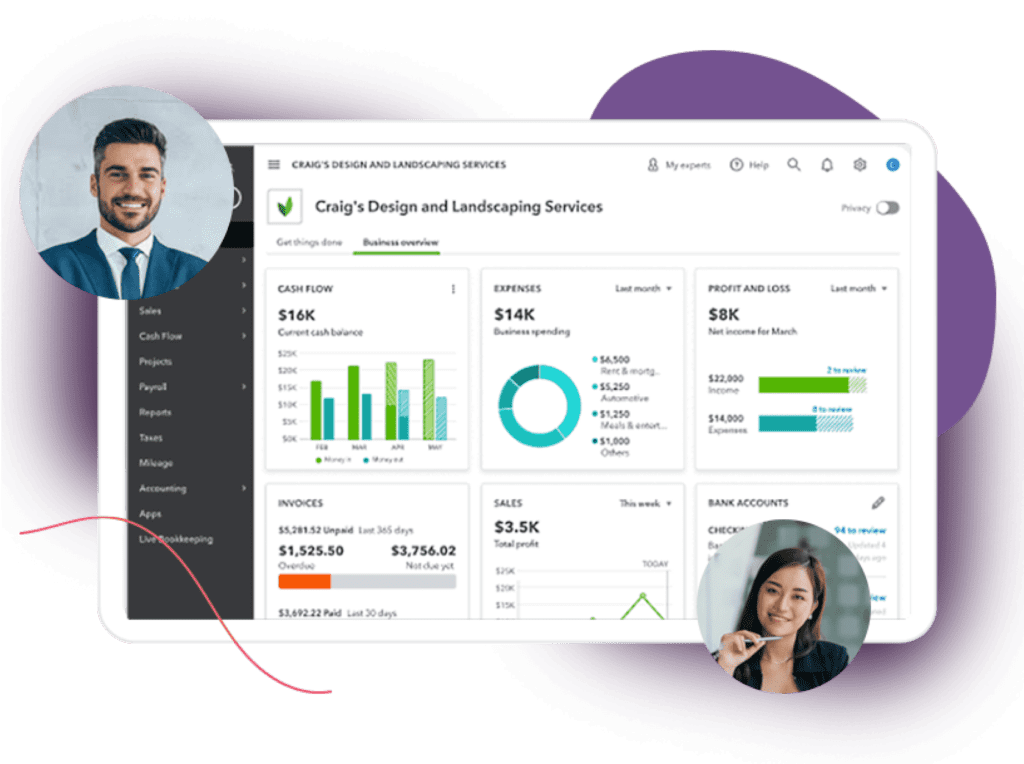

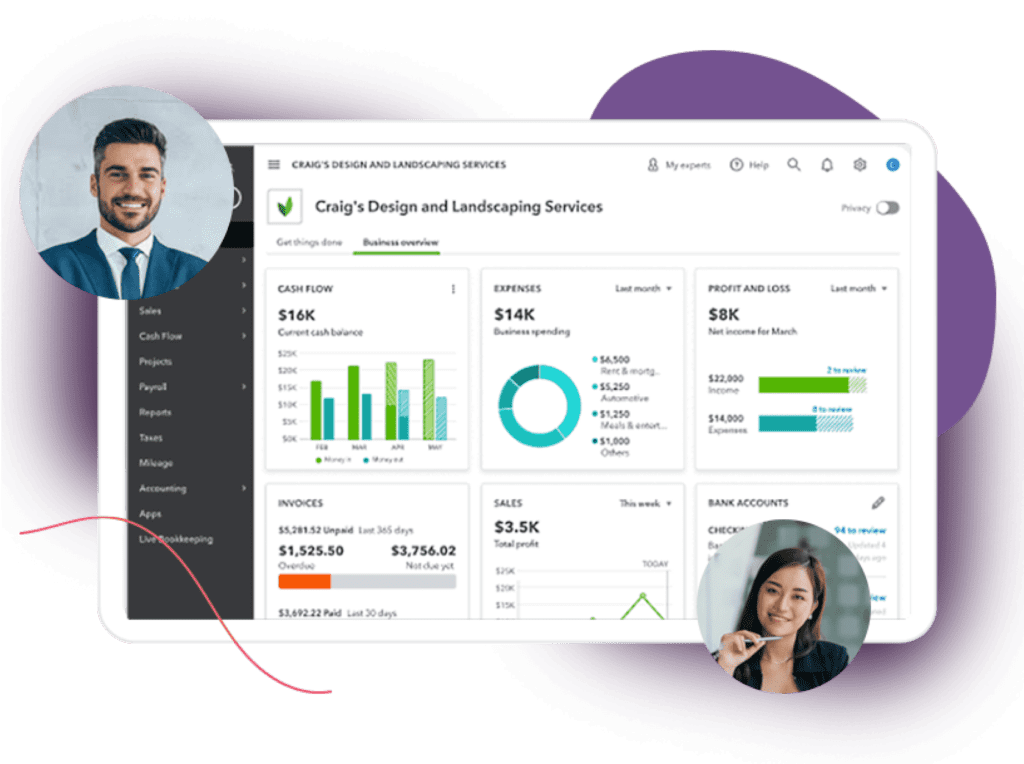

Accountimize: Your Top Accounting Partner

Accountimize serves as your external bookkeeping partner, offering expertise in extracting valuable insights through ratio analysis. Our team of seasoned CPAs is well-versed in the art of ratio analysis, allowing us to uncover critical data about your company’s financial performance and position. By leveraging the latest accounting software and tools, we can assist you in identifying areas for improvement and make informed decisions for sustainable growth.

Contact us today to gain access to a wealth of expertise in ratio analysis, ensuring that you harness the full potential of your financial statements to drive your business forward.

Ready To Make The Decision?

Meet your dedicated team of experts today and get started with your growth journey