A Closer Look at Revenue vs. Profit

Feb 06, 2024 | 25 Min Read

Contents

Want to learn the next steps?

Our experts are here to assist you in discovering your business growth

Share This Blog

Operating a business and managing finances lead entrepreneurs to two essential terminologies: revenue and profits. What they are, their differences, and how they can be maximized are all discussed in this blog.

What is Revenue vs. Profit

Revenue and profits are crucial elements for understanding the financial performance of a business. Below is a concise explanation of both terms:

Revenue: Revenue is the total income generated from the primary operations of the business. Often referred to as business turnover, top line, or sales, it is the flow of money derived from the sale of products or services the business is offering.

Profit: Profit, also commonly referred to as the bottom line, remains from the revenue after accounting for all business expenses and costs. Profit reflects the business’s efficiency in managing costs and generating a surplus.

How is Revenue Generated

Revenue is generated through several sources, depending on the business model and its core operations. Some common avenues businesses generate revenue from are:

Sales of Products or Services: This is the most common source of revenue for businesses. Also included in this source of revenue are consulting and professional service fees. Typical examples of these are service fees in the legal or accounting industry, where businesses charge clients for expert advice.

Advertising: In today’s digital landscape, businesses often generate large streams of revenue by selling ad space to other companies looking to promote their product or services.

Subscription Models: These are revenue models in which customers periodically pay fees for ongoing access to a product or service. These models are common for businesses operating in industries related to software, streaming, or publishing platforms.

Franchise and Licensing Fees: In this model, franchisees pay franchisors initial fees and royalties on products or services sold, adding to the franchisor’s revenue.

Businesses with intellectual property such as patents and copyrights can generate revenue by licensing these assets to other companies or through royalties on sales.

Donations: Charities and Non-profit organizations also generate revenue which could be through charitable donations or fundraising events.

Brokerage Services: Some companies generate revenue by facilitating transactions between parties and earn commission or brokerage fees. This is common in industries related to financial services and real estate.

In today’s business environment, there are infinite possibilities for earning revenue. Understanding the primary revenue source of a business is crucial for financial planning and decision-making.

Different Types of Profit and How to Calculate Them

Profits are calculated in different stages. Analyzing the business performance at each stage is crucial as it enables them to evaluate their financial performance accurately. The main types of profit include:

Gross Profit: Gross Profit is the profit left after deducting the cost of goods sold from the total revenue. The formula is as follows:

Gross Profit = Revenue – Cost of Goods Sold

Cost of Goods Sold includes expenses directly associated with the production or procurement of goods and services for sale, such as raw material costs or direct labor costs.

Crucial information can be extracted from the Gross Profit such as the business’s efficiency in controlling the manufacturing or procurement costs. It also analyzes the ability to charge higher prices from customers and provides vital data on the demand for the product or service.

Operating Income/Profit: This is the profit generated from the core operations of the business after deducting all operating expenses. Operating expenses include utility bills, administrative costs such as salaries, and other costs related to the day-to-day business operations. This is simply determined by deducting operating expenses from the Gross Profit.

Net Profit: Often referred to as the bottom line, net income, is the most comprehensive measure of profitability. It represents the profit remaining from revenue after deduction of all expenditures, operating and non-operating, such as interest and taxes. The formula is as follows:

Net Profit = Operating Income – Interest – Taxes

EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization: This measure of profitability provides a clear view of a company’s operating performance by excluding non-cash (depreciation and amortization) and financing-related factors. This is calculated as follows:

Net Profit + Taxes + Interest + Depreciation + Amortization

Each type of profit provides specific insights into different aspects of a business’s financial performance. Understanding these types of profits helps in making informed decisions about business operations and investment strategies.

Want to learn about the next

steps for growing your business ?

Importance of Revenue and Profit

Revenue and profit are vital financial metrics for any business. Both metrics serve a unique purpose and collectively provide a holistic view of the financial health of the business. The significance of revenue vs profit is discussed below:

Importance of Revenue:

Business Growth: Revenue is an indication of the company’s ability to generate income, expand its customer base, and enhance its market reach. A consistently growing top line is an indicator that the company is able to sell its products, increase market share, and receive positive feedback from customers.

Without an adequate flow of revenue, businesses cannot invest in growth and cover expenses, leading to the ultimate shutting down of the company.

Investor Confidence: Current and potential investors commonly use sales as a barometer of the existing scale and future potential of the business. Businesses posting strong revenue growth figures are often more attractive to investors and enhance the valuation of the business.

Comparison: Businesses can benchmark past year revenue with current year revenue, and current year revenue or growth with competitors’ figures. This helps in assessing the success of the business and its industry’s standing.

Importance of Profit:

Return on Investment: Profitability is a key indicator of return on investment for investors and shareholders. A business consistently generating profits and efficiently handling working capital can cover costs, reinvest in growth, potentially pay dividends, and stay in business for the long run. Profitable businesses are attractive to investors as they can confidently recover their initial investment.

Unexpected Events: Healthy profits increase the retained earnings of the business, acting as a buffer against economic downturns and unexpected expenditures.

Competitive Advantage: With the surplus funds available due to higher profitability, businesses can form a competitive advantage over others by investing in marketing activities, research and development, or by launching innovative products. This can help companies stay ahead of competitors during tough times.

Business Sustainability: Profits reflect the efficiency of business operations. A strong profit figure demonstrates the long-term sustainability of the company’s operations and confidence in the business strategy.

In summary, both financial metrics are significant for assessing a company’s financial performance and making informed decisions.

Strategies for Maximizing Profits

One of the primary objectives for businesses is profit maximization. Some of the strategies a business can employ to maximize profits are discussed below:

Pricing Strategies: Maximizing revenues can lead to profit maximization. Managers should assess pricing strategies regularly to determine the optimal balance between revenue maximization and market share. With the introduction of digital business, dynamic pricing has become the optimal pricing strategy for all companies.

Cost Control: While price setting is significant, it is only beneficial if the business has strong control over costs. Managers should regularly review and analyze both fixed and variable costs, identifying areas for cost savings without compromising on quality or customer satisfaction. Better pricing and payment terms should also be negotiated with suppliers to further improve margins.

Managers must also pay attention to inventory accounting to reduce carrying costs and implement strategies such as just-in-time to reduce warehousing expenses.

Market Expansion: Companies can increase margins by targeting new geographic areas or customer segments.

Product Range: Rather than offering a standard product range, entrepreneurs should consider diversifying their offerings to attract additional customers or to increase the average transaction value of existing customers. This can be done by upselling or cross-selling. Upselling is to encourage the purchase of a higher-end product while cross-selling is done to encourage customers to purchase complementary products.

Marketing Tactics: Investing in targeted marketing campaigns can help reach a broader audience and increase brand visibility. This can be done by leveraging digital technologies and social media platforms to increase reach. Data analytics should be carried out to ensure the success of the marketing campaigns.

Customer Retention: Retaining profitable customers is essential for all businesses. This is possible by implementing customer loyalty programs, providing top-quality customer service, and encouraging their active feedback on product quality, new ideas, and areas for improvement.

Employee Engagement: Encourage employees to generate new ideas for cost-efficiencies and revenue maximization. Businesses should invest in employee training to enhance productivity, resulting in a positive impact on the bottom line.

Leveraging Technology: Digital processes result in automation, reducing manual labor and improving customer experience.

Collaboration: Businesses could consider sharing resources such as warehousing to reduce storage costs or making bulk purchases to decrease material costs. Strategic mergers and acquisitions can increase market share and lead to access to advanced technology and expertise.

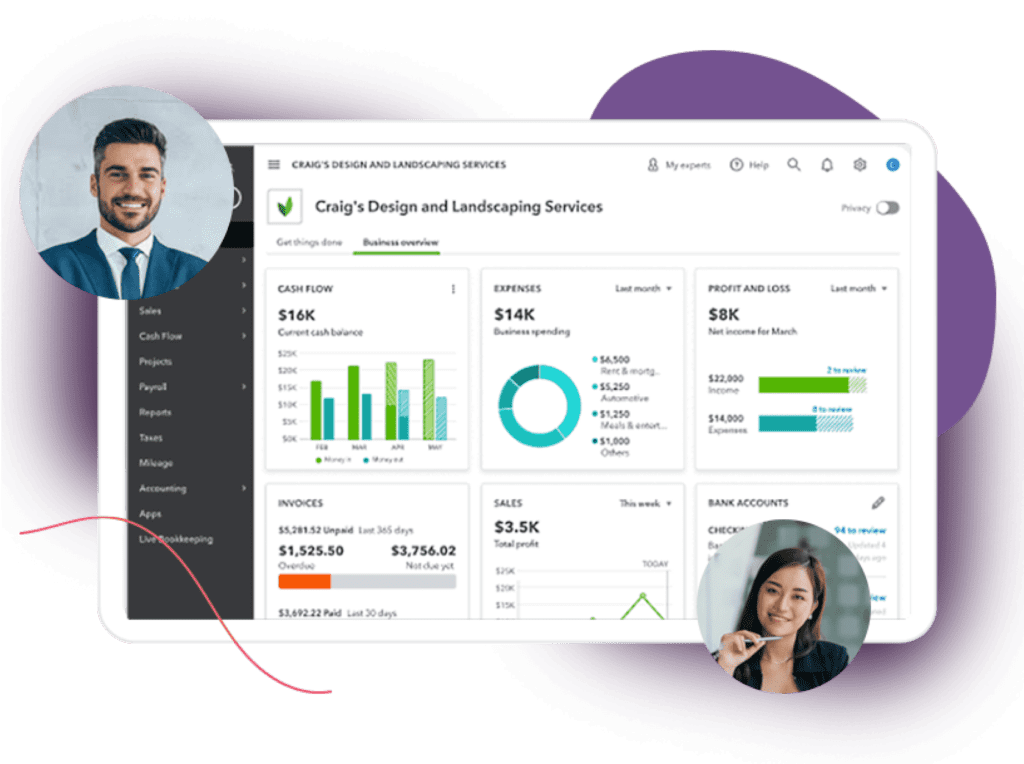

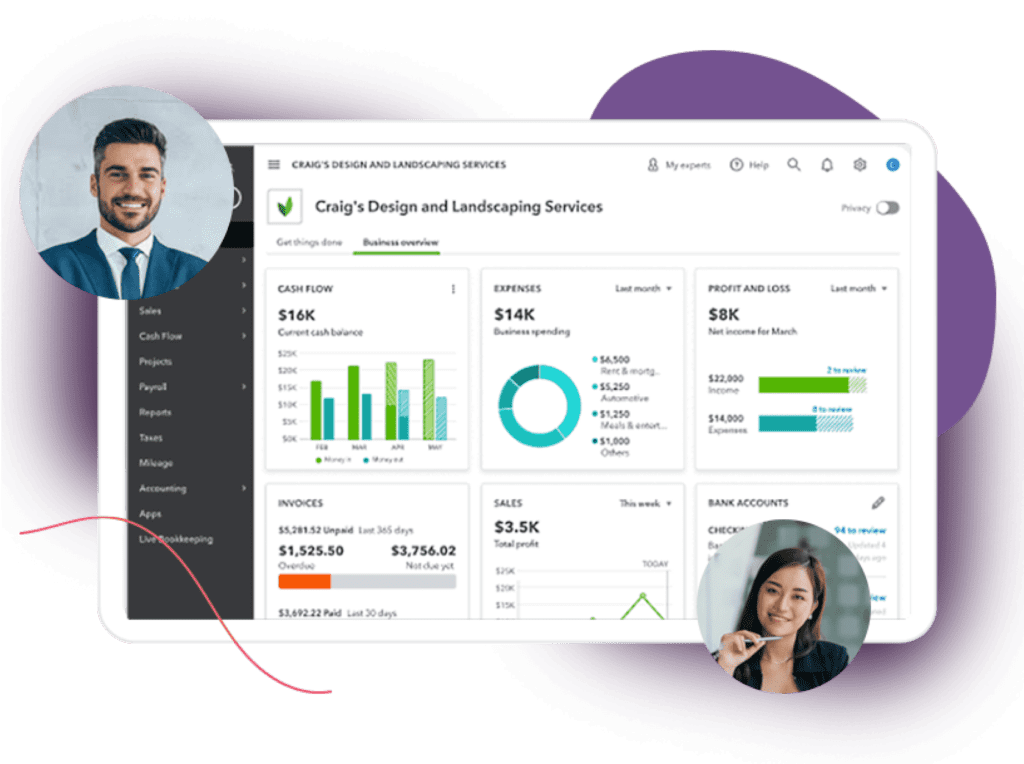

Accountimize: Your go-to Accounting Solutions Partner

Whether you’re a small business or a large enterprise, managing your finances efficiently is crucial for a healthy business. Accountimize is your go-to partner for all your accounting solutions, providing several offerings such as bookkeeping, taxation, and financial reporting services.

We employ the best industry practices to equip your business with data-driven insights for a deeper understanding of revenue and profits, enabling you to make informed decisions about the success of your business.

Ready To Make The Decision?

Meet your dedicated team of experts today and get started with your growth journey