How to calculate Net Income for Financial Success

Feb 22, 2024 | 13 Min Read

Contents

Want to learn the next steps?

Our experts are here to assist you in discovering your business growth

Share This Blog

Net income serves as a barometer of financial health and long-term success for businesses. It acts as a compass for businesses to navigate through complexities to achieve long-term sustainability.

Significance of Determining Net Income for Small Businesses

Net income represents the residual income of the business after deducting all expenses, including operating expenses, finance costs, and taxation. For small businesses, net income holds immense significance as it directs the management toward more efficient decision-making, ultimately guiding the business toward long-term success.

Some key reasons for determining net income are:

- Measure of Profitability: Net income determines the profitability of the business, highlighting the effectiveness and efficiency of business operations in controlling expenses. It enables small business owners to determine if their business model is sustainable in the long run.

- Financial Planning: Entrepreneurs can use forecasts of net income to create realistic budgets, set financial goals and allocate resources accordingly. This can lead to better management of cash flows, ensuring the financial stability of the business.

- Performance Evaluation: Net income serves as a Key Performance Indicator (KPI), enabling businesses to evaluate their performance over time. By comparing net income margins against industry benchmarks or past performance, business owners can identify areas of improvement, and make informed decisions to drive growth and profitability.

- Seeking investments or financing: Investors and lenders often use net income as a key metric in evaluating the creditworthiness and feasibility of a business. A healthy bottom line increases the likelihood of securing funding for growth and expansion.

Tax Planning: Accurate calculations of net income through the income statement can help in determining the tax liability of the business, taking advantage of deductions and credits, as well as ensuring compliance with tax laws, thereby reducing the risk of audits or penalties from the authorities.

Calculating Net Income for Financial Success

Net income is a fundamental component of financial management, as it provides valuable insights into the financial health of a business. The following items are required in calculating net income, and are often displayed in the form of an income statement:

Revenue: The revenue of the business represents the total income generated from the sale of goods or services.

Cost of Goods Sold: Cost of Goods Sold includes all direct costs associated with producing or purchasing the products sold by the business, such as materials, labor, or production overheads. This is subtracted from total revenue to calculate the gross profit. This explains the difference between revenue vs profit.

Operating Expenses: These include costs such as salaries, utilities, rent, and other administrative or day-to-day costs. This is deducted from gross profit. Depreciation and amortization are non-cash expenses, representing a gradual fall in asset prices, often due to wear and tear or obsolescence. These too are deducted in the calculation for net income.

Interest and Taxes: Any taxes calculated on profits and interests charged on loans must also be accounted for when determining net income.

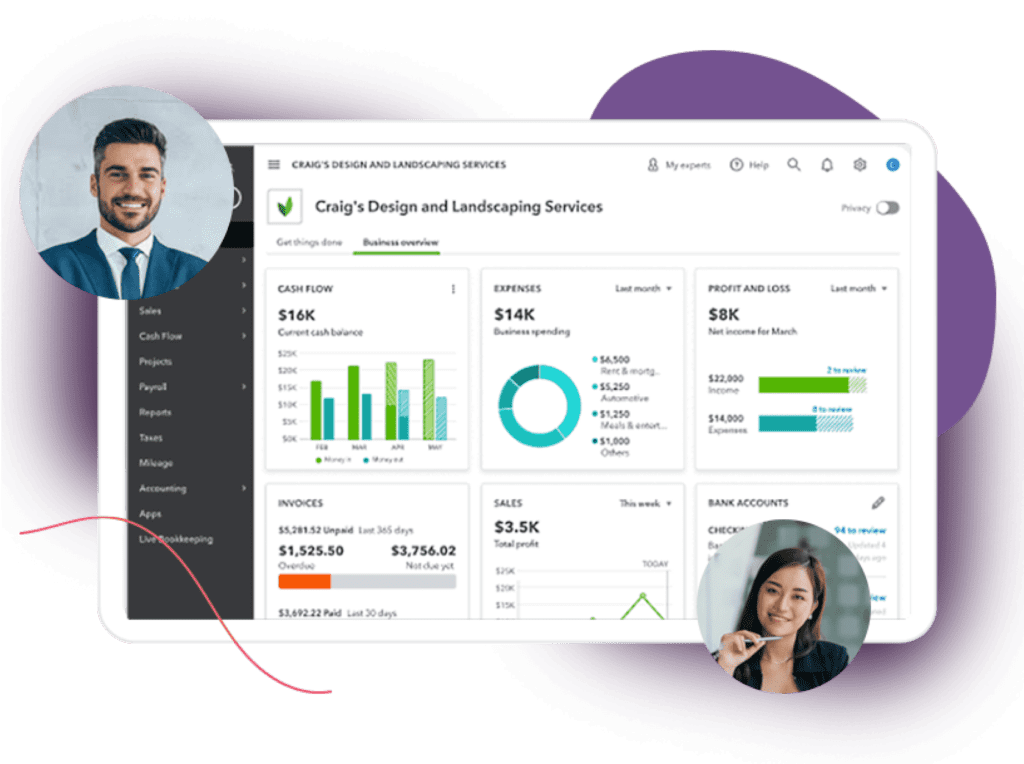

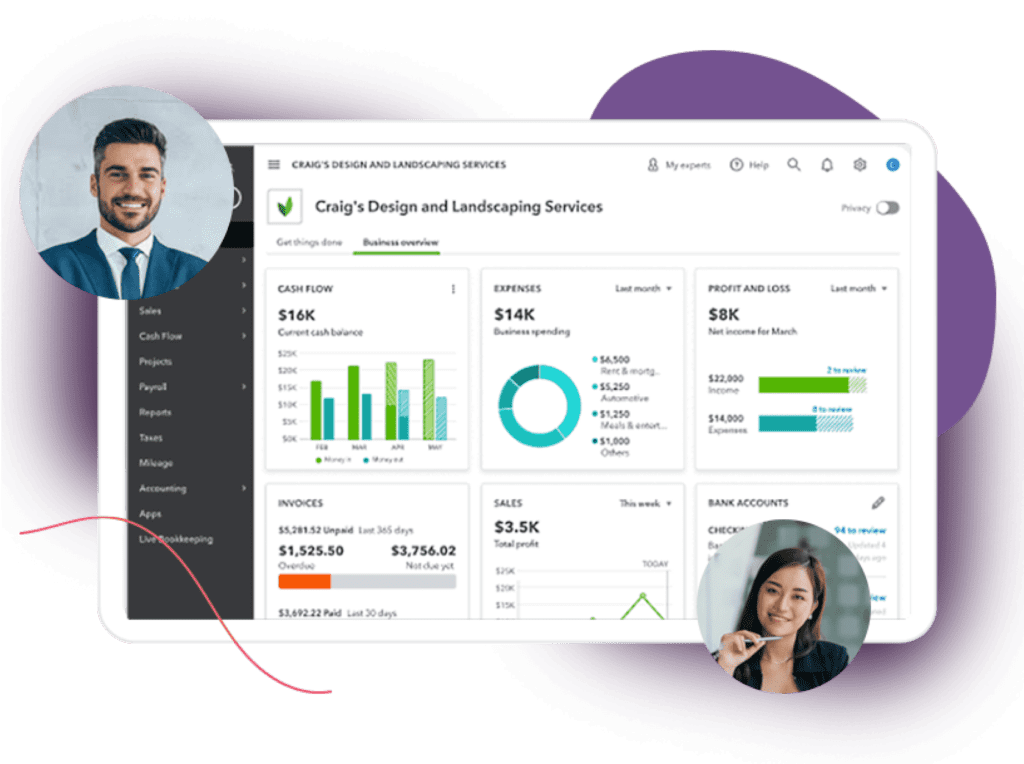

Once all these expenses have been accounted for, the final figure will represent the net income of the business. By regularly monitoring net income, especially with the help of online accounting services such as Accountimize, as well as using top-notch software for dashboarding and real-time analysis of net income, entrepreneurs can make informed decisions to improve growth and profitability.

Want to learn about the next

steps for growing your business ?

Strategies to Improve Net Income for Small Businesses

Increasing Sales: This can be done by expanding the product offerings of the business to attract new customers or tap new markets. Sales can also be increased through promotions or loyalty programs to increase customer retention. Enhancing customer service and experience can increase customer loyalty and retention as well.

Price Optimization: Market research should be conducted to understand the perception of customers and the competitive landscape of the business. Pricing strategies should be adjusted using dynamic pricing models to maximize net income while remaining competitive in the market. Products could be bundled to create more value for customers and increase transaction size.

Expense Reduction: This can be done by negotiating more favorable terms with suppliers, outsourcing non-core functions to reduce overheads to focus more on core operations, or implementing just-in-time or vendor-managed inventory to reduce warehousing and handling costs.

Businesses should consider investing in technology and automation tools to streamline processes, thereby improving productivity.

Leveraging Net Income for Small Business Growth

Businesses can consider reinvesting their profits into the business, to expand product offerings, upgrade infrastructure, reduce liabilities, or for improved working capital.

Profits can also be retained for marketing campaigns, to enhance market share, and customer awareness, and to enter new geographical regions or customer segments. This can prevent businesses from being dependent on a single segment or geographical area. Furthermore, investing in talent acquisition as well as research and development can fuel innovation, enabling your business to stay ahead of competitors, while also meeting evolving customer needs.

Prudent financial management guided by a thorough understanding of net income allows small businesses to weather economic storms and seize growth opportunities.

How Accountimize can help businesses calculate net income for financial success

Accountimize is an online accounting services provider employing the latest technology and automation tools to streamline processes and improve the profitability of the business.

With an array of services tailored to streamlining bookkeeping, providing payroll processing services, and preparation of financial statements such as the income statement, Accountimize empowers entrepreneurs to focus on what they do best – building and growing their businesses.

Ready To Make The Decision?

Meet your dedicated team of experts today and get started with your growth journey